In this article, we will explore the process of finding the web design studio near you. Whether you are a small business owner or an entrepreneur looking to revamp your existing website, the following guidelines will help you make an informed decision and choose a web design company that aligns with your specific requirements.

Utilizing Tips and Tricks for a Successful Simple Web Design Project

In today’s digital age, having a well-designed website is essential for businesses and individuals alike. Whether you’re an entrepreneur looking to promote your brand or

Understanding the Basics of Simple Web Design

In today’s digital age, having a well-designed website is essential for any business or individual looking to establish a strong online presence. Whether you’re an

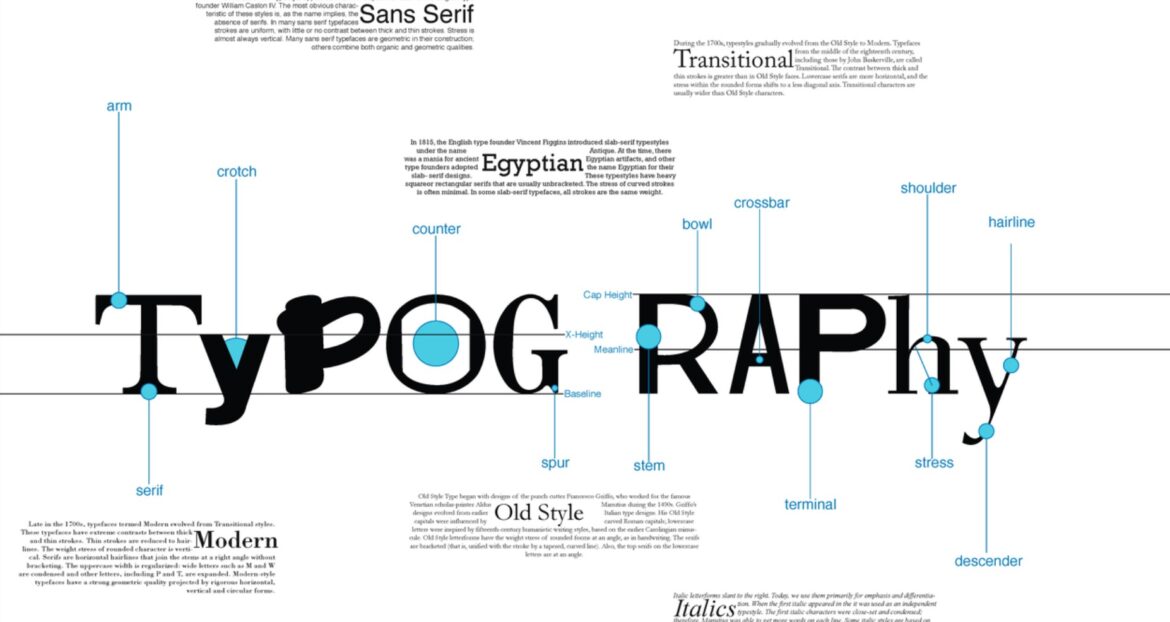

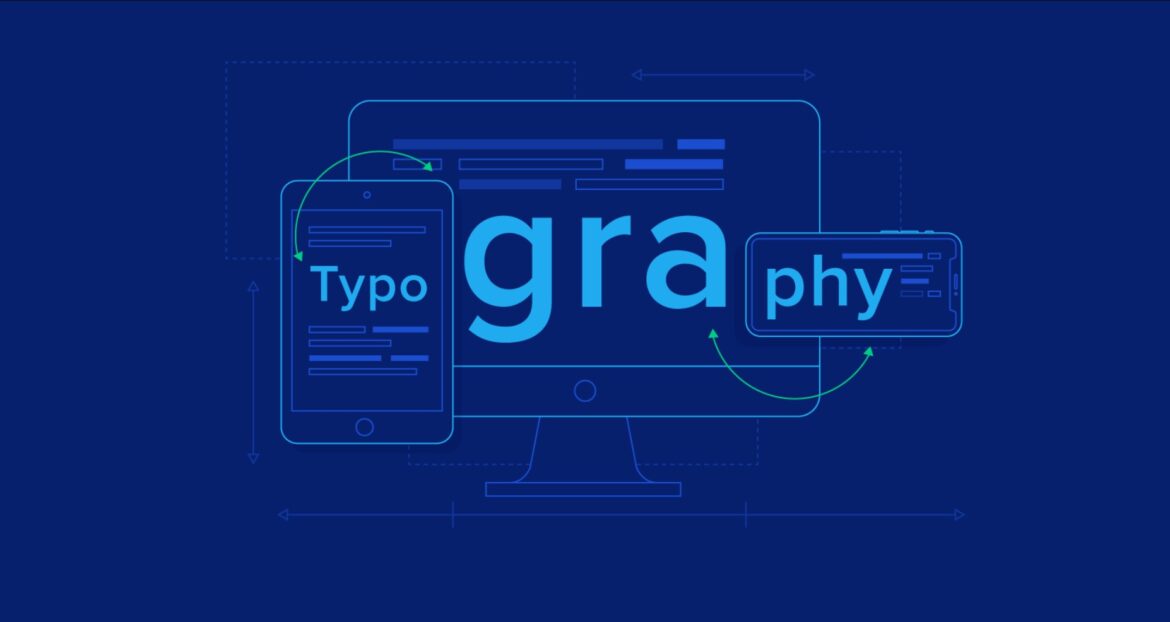

Creating a Balanced Layout with Effective Website Typography Techniques

In today’s digital age, having a visually appealing and user-friendly website is crucial for any business or individual looking to establish an online presence. One

Tips for Designers on Improving Website Readability through Appropriate Typography

When it comes to designing a website, one crucial factor that often gets overlooked is typography. The choice of fonts, sizes, spacing, and other typographic